I have often been asked: “what is carbon pricing and how would it affect me?”

There is a long response to the “what is it” question (Incropera, 2015), but a short answer should suffice. Simply put, carbon pricing is a public policy instrument that assigns a cost to greenhouse gas emissions. It can be implemented in two ways. One approach is to simply levy a tax on emissions. For example, a carbon tax could be added to the cost of the gasoline used to operate your vehicle. Or, a tax could be added to your electric utility bill commensurate with the emissions produced by generating the electricity. A second, less direct approach involves a cap-and-trade process. Government imposes a cap on economy-wide emissions and distributes or auctions allowances to emitting entities such as oil refineries and power plants. The allowances can be traded on an exchange – sold by entities capable of operating under their caps and bought by those unable to do so.

The two approaches have a common purpose, namely to put a price on carbon emissions that discourages consumption of fossil fuels and encourages investment in carbon-free energy technologies. Whether it’s the price of an emission allowance or an outright tax, carbon pricing imposes additional costs on fossil fuels that are borne by individuals and businesses using the fuels. So let’s just call it a tax. How then would the tax affect the cost of a fossil fuel or a by-product of the fuel? By how much would the cost of a gallon of gasoline or a kilowatt-hour (kWh) of electricity increase?

The following material answers the second question. Don’t be daunted by the equations. They reveal the pertinent parameters, and the final results are easily used to determine the effect of a tax on your pocketbook.

Transportation Fuels

To determine the effect of a carbon tax on the price of a transportation fuel, we need to know three things, the mass density of the fuel ρ (its mass per unit volume), carbon content CC (the mass of carbon per unit mass of fuel), and the amount of the tax T, which is commonly expressed in dollars per tonne (1,000 kilograms or 2,205 pounds) of carbon emissions ($/t-C).1 Assuming complete combustion of the fuel and release of all of its carbon to the atmosphere as carbon dioxide, the amount by which the price of a gallon of gasoline increases due to a carbon tax, ΔP, can then be expressed as

For gasoline, which has a nominal density of 720 kg/m3 and a carbon content of 0.86 kg-C/kg-fuel,

The quantities in brackets provide conversion factors needed to express the final result in $/gal. It follows that

(1)

And there you have it. Just substitute the amount of the tax in dollars per metric ton of carbon, and calculate its effect on the price of a gallon of gasoline. A tax of $10/t-C yields $0.0234/gal, or a little more than 2 cents. A tax of $100/t-C yields $0.234/gal, or a little more than 23 cents a gallon.

How much would the price of gasoline have to increase to affect consumption? What would it take to encourage the purchase of vehicles that provide better fuel economy or to encourage alternative modes of transportation? Would $10, $100 or $400/t-C do it?

For diesel, the only thing that changes is the density of the fuel. With a nominal density of 865 kg/m3, the effect of a carbon tax on the price of a gallon of diesel is

(2)

Electricity

To determine the effect of a carbon tax on the cost of electricity, we need to know four things, the carbon and energy content of the fuel, the efficiency with which the power plant converts the energy of the fuel to electrical energy, and the amount of the tax. Consider a modern coal-fired power plant with an efficiency η of 40%. The carbon and energy content of the coal vary according to its source and whether it is bituminous, subbituminous or lignite. For bituminous coal representative values of the energy content, or heating value HV, and carbon content CC for are 28,000 kilojoules per kilogram (kJ/kg-coal) and 0.65 kg-C/kg-coal.

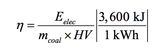

With the efficiency defined as the ratio of electrical energy Eelec to the energy of the coal used to produce the electricity and the energy of the coal expressed as the product of its mass mcoal and heating value, it follows that

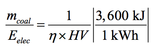

The conversion factor is dictated by use of kilowatt-hours for electrical energy and kilojoules for the energy of coal. Rearranging this expression, the amount of coal consumed per unit of electrical energy in units of kg-coal/kWh is then

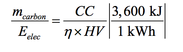

Assuming complete combustion of the coal, the corresponding carbon emissions are

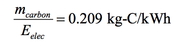

Substituting for CC, η, and HV, it follows that

(3)

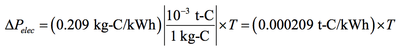

Expressed in $/kWh, the amount by which the price of electricity would increase due to a carbon tax is therefore

(4)

Accordingly, a tax of $10/t-C would yield an increase of $0.00209/kWh − a little more than two-tenths of a cent − in the cost of a kilowatt-hour of electricity. A tax of $100/t-C would increase the cost by $0.0209/kWh, or a little more than 2 cents.2

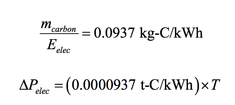

For a modern gas-fired power plant, representative values of the efficiency, carbon content, and heating value are 58%, 0.74 kg-C/kg-gas, and 49,000 kJ/kg-gas, respectively. Carbon emissions per kilowatt hour of electricity and the corresponding effect of a carbon tax on the cost of electricity are then

(5)

Taxes of $10 and $100 per tonne of carbon would add less than $0.001/kWh and $0.01/kWh, respectively, to the cost of electricity.

To Tax or Not To Tax?

Although carbon emissions can be constrained by imposing a tax on the emissions, consideration must be given to its impact on the economy. If set too high, the tax could have adverse economic effects; but if set too low, it would not have the desired effect on reducing emissions.

To mitigate risk to the economy, the tax should begin low and increase gradually, thereby allowing markets to adjust. The potential for adverse economic effects could be eliminated altogether by making the tax revenue neutral, that is, by reducing other taxes (payroll, income and business) accordingly, with priority given to reducing the burden on low-income segments of the population. Most Americans would support a carbon tax if it is revenue neutral, and successful examples are emerging.3

If levied, carbon taxes, should be differentiated according to location and fuel source. For example, in some regions of the world, taxes on transportation fuels are already high and need not be augmented by an additional carbon tax. In other regions, fuel costs are highly subsidized, and the first step to reducing consumption would be to eliminate the subsidies. Taxes on transportation fuels should also differ from those used to generate electricity. For example, in the U.S. the added cost of $0.02/kWh associated with a tax of $100/t-C on emissions from a coal-fired power would do much to reduce consumption, while the added cost of $0.23/gal of gasoline would have little effect on consumption.

1 The amount of a tax can also be specified in dollars per tonne of carbon dioxide ($/t-CO2). Since one atom of carbon yields one molecule of carbon dioxide, 3.67 tonnes of CO2 (the ratio of molecular weights) correspond to 1 tonne of C, and a tax of $100/t-C would correspond to $27.25/t-CO2. Readers should be alert to the fact that dollar amounts are often cited without mention of the units, particularly in the popular press. If a tax on carbon emissions is simply cited as $100 a tonne, is it based on CO2 or C? If based on CO2, it would correspond to $367 per tonne of C.

2 In China, the world’s largest consumer of coal for power generation, the average heating value and carbon content of its coal are 21,000 kJ/kg and 0.55 kg-C/kg-coal (Liu, et al., 2015). For an efficiency of 0.40, the average coal consumption per kWh would then be

3 In 2008 the Canadian province of British Columbia imposed a tax of C$10 per tonne of carbon dioxide (C$36.7 per tonne of carbon), which increased to a final value of C$30 per tonne of CO2 in 2012. The tax has popular support, is revenue neutral, has reduced per capita emissions by about 15%, and has not impaired the provincial economy. It may well be the most successful of numerous carbon pricing measures implemented worldwide (NYT, 2016).

Incropera, F.P. (2015). Climate Change: A Wicked Problem – Complexity and Uncertainty at the Intersection of Science, Economics, Politics, and Human Behavior. Cambridge University Press, New York, pp. 148-156.

Liu, Z., et al. (2015). Reduced Carbon Emission Estimates from Fossil Fuel Combustion and Cement Production in China. Nature 524, pp.335-8 (doi:10.1038/nature14677).

NYT (2016). Proof that a Price on Carbon Works. The New York Times (http://www.nytimes.com/2016/01/19/opinion/proof-that-a-price-on-carbon-works.html).